Part III: How Fear Creates Financial Quicksand

I have been afraid of many things when it comes to money.

In my twenties I was fearful of making ends meet, of doing my taxes correctly, of not having health insurance.

In my thirties I was afraid that I was genetically flawed when it came to money, and would never have the comforts and security I longed for.

In my forties I had a toddler and, after a few short years of discovering the ease of a nice fat corporate paycheck, I was laid off. I’d grown used to that regular income after 20 years of being an entrepreneur. That scared me silly.

Soon after that I entered the world of financial services, and realized there was so much I didn’t know!

How has fear impacted YOUR ability to make, manage, invest or talk about money?

Have you ever noticed a connection between your fear and procrastination?

I have clients that are afraid that if they think about writing a will it means they are going to die (ok, let’s face it, we are all going to die- that guarantee was put in place the day we were born… but rarely do we have control over it)— yet that fear often prevents us from taking action. Of course if you wait until you need a will (i.e. you’re dead), it’s too late.

WHICH IS WORSE?

So, what’s worse? The fear of dying or the fear that if you died suddenly your children will not have your love, guidance, and legacy?

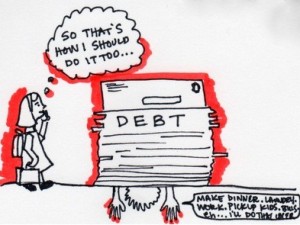

When it comes to money, fear and resistance are a huge part of why people never open brokerage statements, refuse to return their financial advisors’ phone calls, or simply avoid the phone/mail/computer all together.

You might be afraid of seeing the truth of how much debt you are in, or how much you lost when the market dropped. Your fears may be founded in reality or completely imaginary stories.

FIVE TIPS FOR DEALING WITH FEAR:

1) Think of a current situation where fear is the reason you are procrastinating and answer this prompt:

“The story I’m telling myself about this is….”

Often what you’ll find is that your internal story isn’t based in current reality, and once you walk yourself through the quicksand you’ll discover you actually can take some steps forward.

2) Make a list of five things you could do to strengthen and/or heal your relationship with money. It might look like this:

- Find out exactly how much debt I am carrying

- Call the hospital to dispute a bill

- Make an appointment with an estate planning attorney

- Talk to my partner about my shame around spending money I know we don’t have

- File last year’s taxes

Then choose the one that’s scariest, and do it.

3) Take a mindfulness moment before dealing with something that scares you. Typically our fears are future oriented, yet if we breath slowly and feel our bodies and become fully present the fear dissipates.

4) Ask for help! Some things are simply too daunting to face alone.

If you haven’t looked at your brokerage statements in six months, or feel so disorganized that you often miss paying bills, consider hiring a professional to help you until you have a system in place that soothes your nerves and simplifies your life. Check out the American Association of Daily Money Managers at www.aadmm.com.

5) Take baby steps and take notes: Use your journal to record the little ways you are standing before your fear and still moving forward.

It’s powerful to look back and see the evolution—yet when you are inside the experience of growing, it’s difficult to see progress. Simply make notes— your feelings, reactions to money situations, list things you are afraid to handle. It’s all important.

How else do you think we, as humans, allow fear to impact our ability to make good financial decisions? Have you seen it happen?