In five minutes a day you can accomplish so much. Really…you have to try it.

In five minutes a day you can accomplish so much. Really…you have to try it.

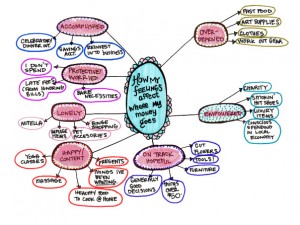

What I’ve noticed is that clients that pay attention to their money are more likely to feel competent, to notice important details, and most importantly, they ask great questions.

Curiosity, when it comes to money, is your new BFF. Spend five minutes a day for a week or a month, and I promise that you will feel better. Couple this practice with noting one thing you are grateful for, that is related to money, and you will begin to transform your relationship with money. You might even start a money journal to chronicle how you spent your five minutes, your daily gratitude, and a sentence about how you are feeling.

Five Minutes a Day

Strategy #1 Weekly Check-In

Monday — Check your credit card balances (note how much interest you are paying)

Tuesday — Check your household checking account, review transactions

Wednesday — Review your brokerage account, note market changes, activity, fees paid

Thursday — Follow a stock—every week note how much it’s trading for and read some of the news about the company

Friday — Check your business checking/savings accounts. If you don’t have a business, you might do one thing each week from the list below.

Strategy #2 Random Tasks to Check off

- Find out the interest rate on your savings account(s).

- Find out the interest rate and balances on your credit card debt.

- Review the interest rate and balance owed on your mortgage.

- Check on how much life insurance coverage do you have?

- Review your will/trust, power of attorney. If you don’t have one, get one.

- Spend five minutes looking up one of your investments (a stock or mutual fund) and learn more about it. I like Google or Yahoo Finance for this purpose.

- Call your financial advisor or financial planner and ask them how they get paid, and to describe how your portfolio is doing. If you don’t have one, consider getting an appointment with someone who will give you a free 30-60 minute evaluation of your investments.

- Fund a Roth IRA (if you have to open one it will take more than 5 minutes—but adding money to it? That’s easy!)

- Find out what your Adjusted Gross Income (AGI) was for [2013] (look on your tax return).

- Read your paystub carefully, and make sure you know what every deduction is for. Call your HR department if you have questions.

- Increase your 401k or IRA contribution by 1-5%.

- Instead of buying another latte or craft beer, deposit that amount into a savings account.

- Open an account for a wild dream you have—then add something to it every week. Name the account. For example: Paris [2015] or Artist Retreat in Mexico [2014] or Masters Degree in Psychology [2018].

Let me know how it goes in the comments below—and if you have other ideas for great ways to spend five minutes a day building your financial muscles!